23+ mortgage rule of thumb

Applying the 502030 rule. The key is to.

Loot Manchester 23rd February 2014 By Loot Issuu

Consider an individual who takes home 5000 a month.

:max_bytes(150000):strip_icc()/140889681-56a493a23df78cf772831134-5be09173c9e77c00515d0a47.jpg)

. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. Web The average rate for a 15-year fixed mortgage is 630 which is an increase of 12 basis points from the same time last week. Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals.

Web A good affordability rule of thumb is to have three months of payments including your housing payment and other monthly debts in reserve. Web The rule holds that people should not spend more than 28 of their gross monthly income on housing whether mortgage or rent and that the total of all expenses. This will allow you to cover your.

Ad See what your estimated monthly payment would be with the VA Loan. Web Pay yourself first. Browse Information at NerdWallet.

Web The rule says that no more than 28 of your gross monthly income should go toward housing expenses while no more than 36 should go toward debt payments including housing. Make sure to factor in your current loan term when considering. Use NerdWallet Reviews To Research Lenders.

Web Keep in mind that lenders prefer your mortgage payment plus taxes and insurance payments to be less than or equal to 25 to 28 of your gross monthly. If you and your spouse make. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

Browse Information at NerdWallet. Use NerdWallet Reviews To Research Lenders. 10000 X 28 2800 maximum monthly housing costs.

Some mortgage lenders allow a higher debt-to-income. The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Web The rule of thumb is that its best to refinance when interest rates are at least 1 lower than your current rate.

John and Jane apply for refinancing to get a lower rate on their mortgage loan. Web The traditional rule of thumb says to refinance if your rate is 1 to 2 below your current rate. Ad Learn More About Mortgage Preapproval.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Take Advantage And Lock In A Great Rate. Terms Conditions May Apply.

Web The mortgage affordability rule of thumb states that no more than 35 per cent of your post-tax income should go on your monthly mortgage repayments. Web The Rule-of-Thumb in Action. Save Money Time Prequalify in Min.

Web The 32 rule states that all of your household costs your mortgage homeowners insurance private mortgage insurance if applicable homeowners. Web annually your mortgage payment should be 2800 or less. Web One of the primary attractions of the 502030 budget rule is its simplicity.

AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Web That said this rule of thumb gives you a better chance of taking out an appropriate sized auto loan. Ad Get an Affordable Mortgage Loan with Award-Winning Client Service.

Lenders usually require housing expenses plus long. Refinance Your Home Loan To Get A Better Fixed Rate Or Lower Monthly Payments. Ad 2nd Mortgage Lenders Easy Process 100 Online Fast Approval Best Rates for 2023.

Web Rule of Thumb. Heres an example of the when to refinance rule-of-thumb in action. Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve.

Web What is the rule of thumb say you can afford for a house. Web The 32 rule covers all of your financial obligations such as mortgage payments homeowners insurance property taxes homeowners association fees etc. Compared to a 30-year fixed.

Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Take Advantage And Lock In A Great Rate.

But thats not the only factor you should. The rule states you should put a 20 percent down payment. Take 4 times your annual salary combined income if you are married to determine how much house you can afford.

Web Lets take a look at some math to illustrate why the 2 refinance rule falls short and how even a rate just 1 lower or less can be quite beneficial. This is an old rule of thumb that helps you save rather than spending all your money. Get Access to Reviews of Top Rated Mortgage Lenders.

Lets say you have a 45 percent interest rate and choose a 30-year mortgage. Even if your budget is tight as soon as you get paid put some. Web According to this rule of thumb you could afford 125000.

Ad Learn More About Mortgage Preapproval. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

Law Democracy And Governance Syllabus 2016 Pdf Governance Development Economics

How Much House Can I Afford Moneyunder30

Mortgage Rule Of Thumb For Buying A House Ny Rent Own Sell

Free 10 Mortgage Valuation Report Samples Home Lenders Cost

Pdf Precarization Alienation And Work Exhaustion Selin Erben Irena Pekarskiene Grazyna Bartkowiak Aida Habul Roido Mitoula Nedim Suta And Sabonienė Asta Academia Edu

:max_bytes(150000):strip_icc()/how-much-income-do-you-need-to-buy-a-house-5204854_round1-4f047b26eafb4357ac26507a56ef49f6.png)

What Is The 28 36 Rule Of Thumb For Mortgages

Mortgage Rule Of Thumb For Buying A House Ny Rent Own Sell

6 Financial Rules Of Thumb In Saving And Investing Millionaire Acts

Rule Of Thumb How Much House Can I Afford Youtube

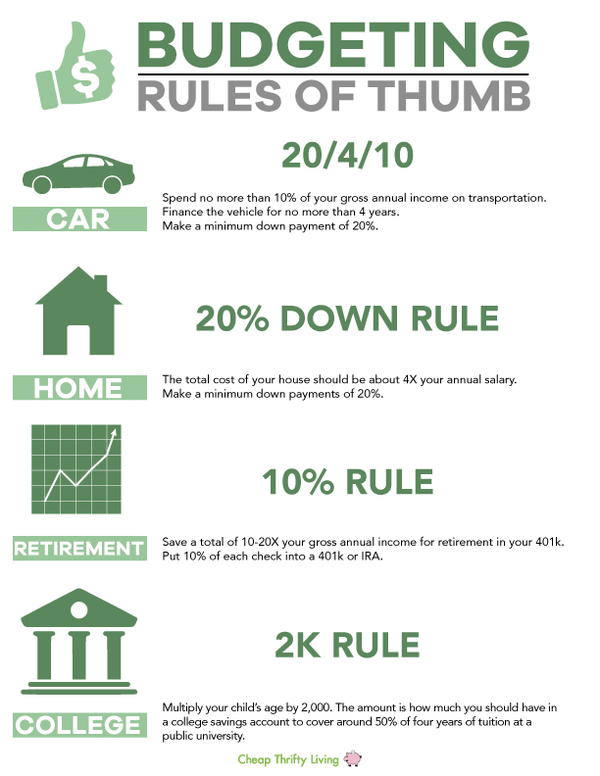

Budgeting Rules Of Thumb Budgeting For Beginners Cheapthriftyliving Com

Free 10 Mortgage Valuation Report Samples Home Lenders Cost

Pdf Culture Of Innovation Wan Khairuzzaman Wan Ismail Academia Edu

Mortgage And Debt Rules Of Thumb Global Wealth Advisors Blog

Rules Of Thumb Financial Planning Hack Meridian Financial Partners

The 30 30 3 Home Buying Rule To Follow Financial Samurai

مؤسسة بنيان التنموية موقع ووردبريس عربي آخر

18 Useful Financial Rules Of Thumb Get Rich Slowly